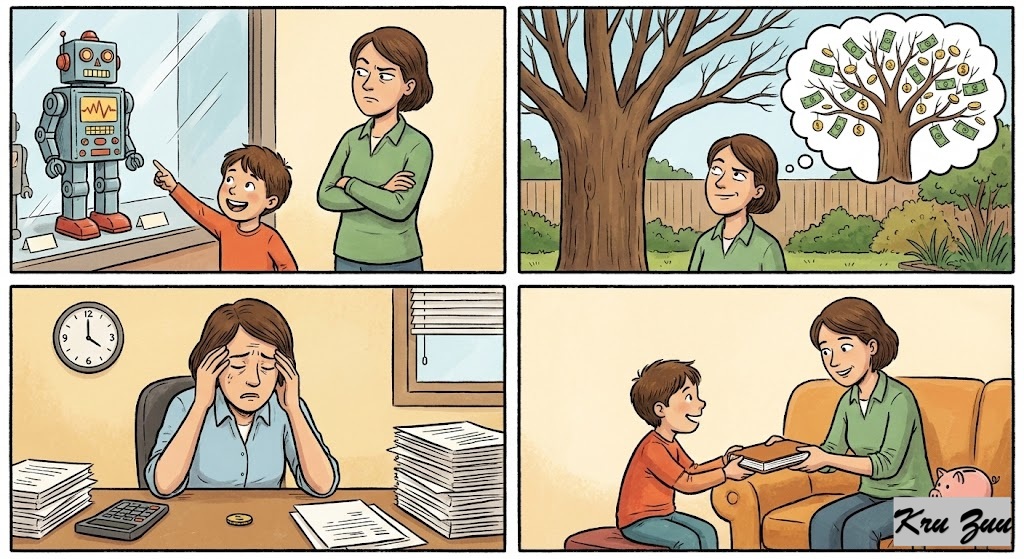

“Money doesn’t grow on trees.”

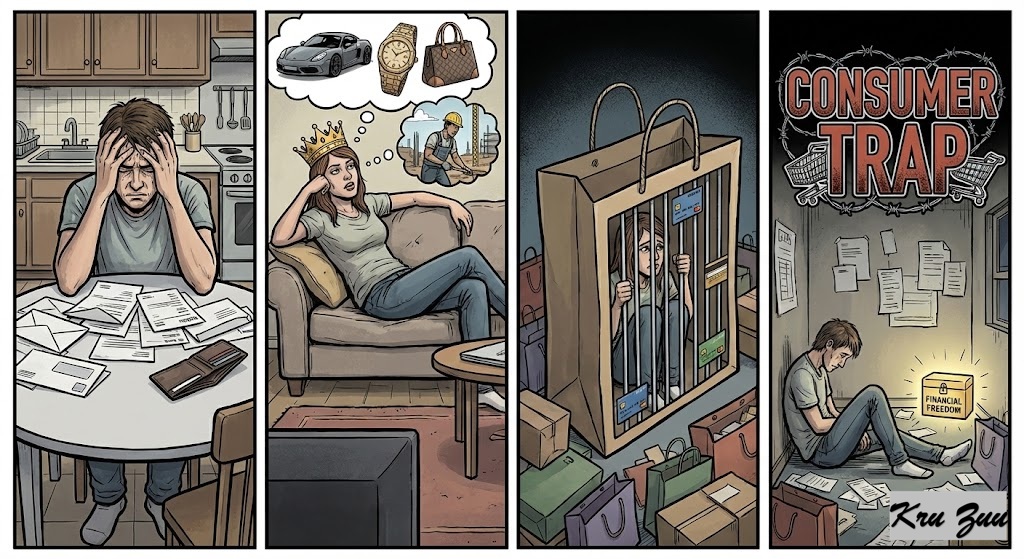

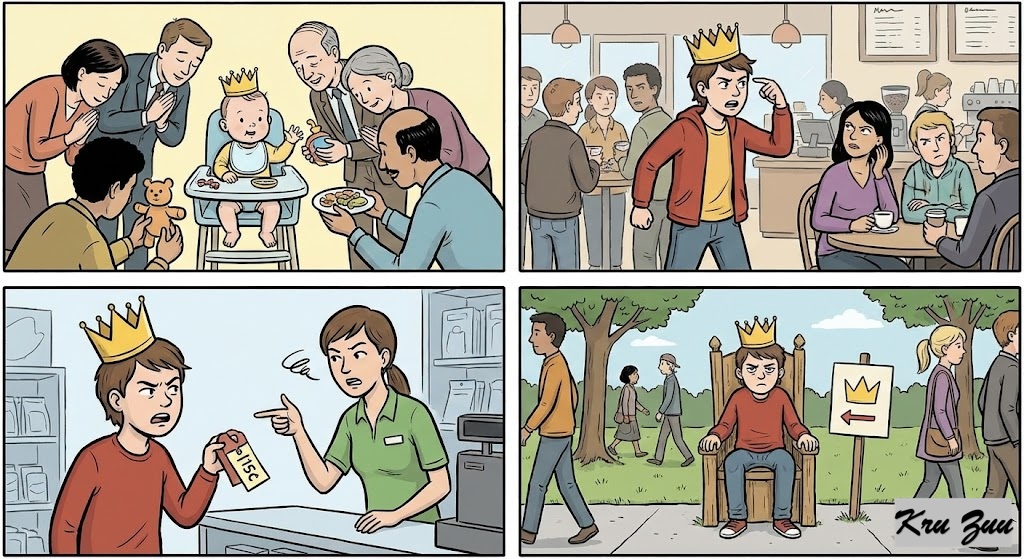

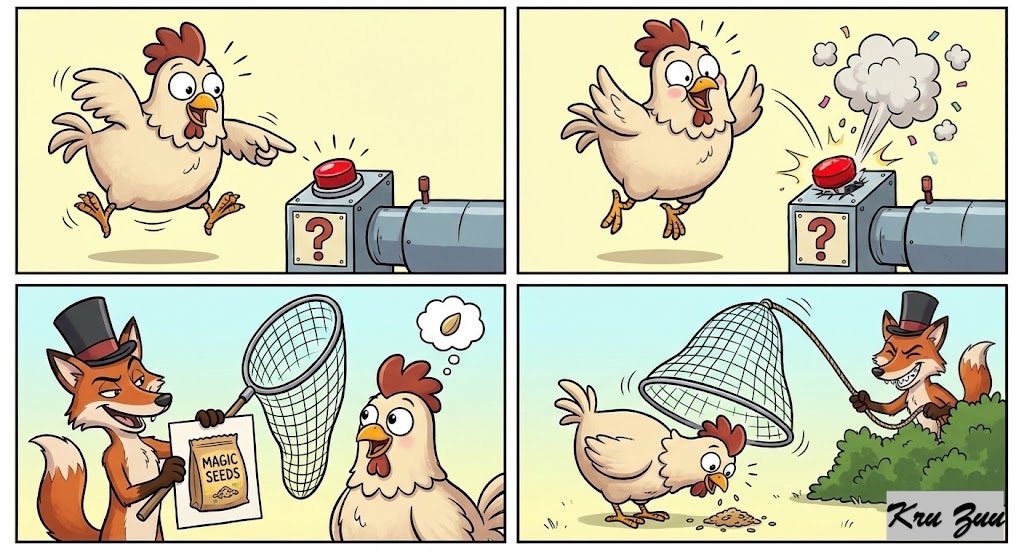

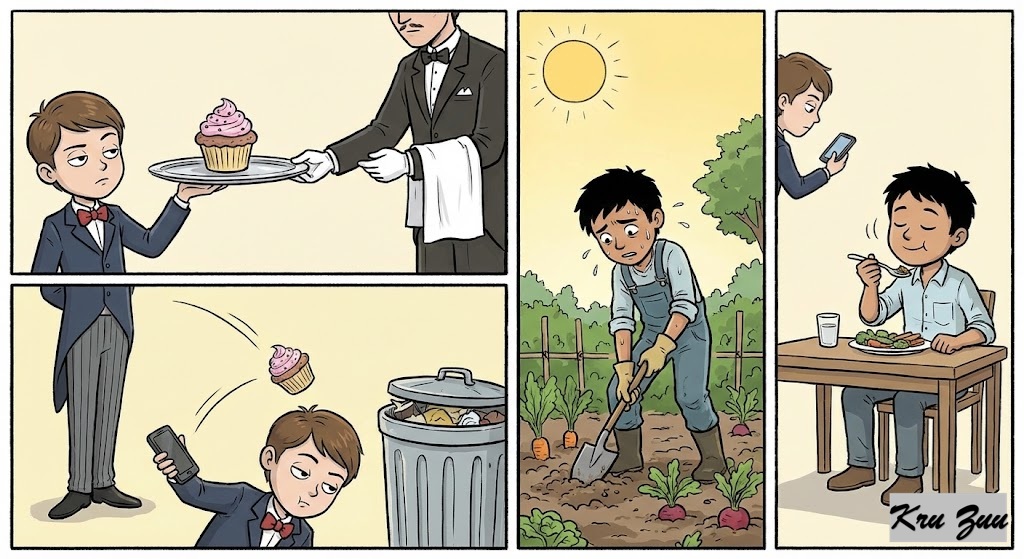

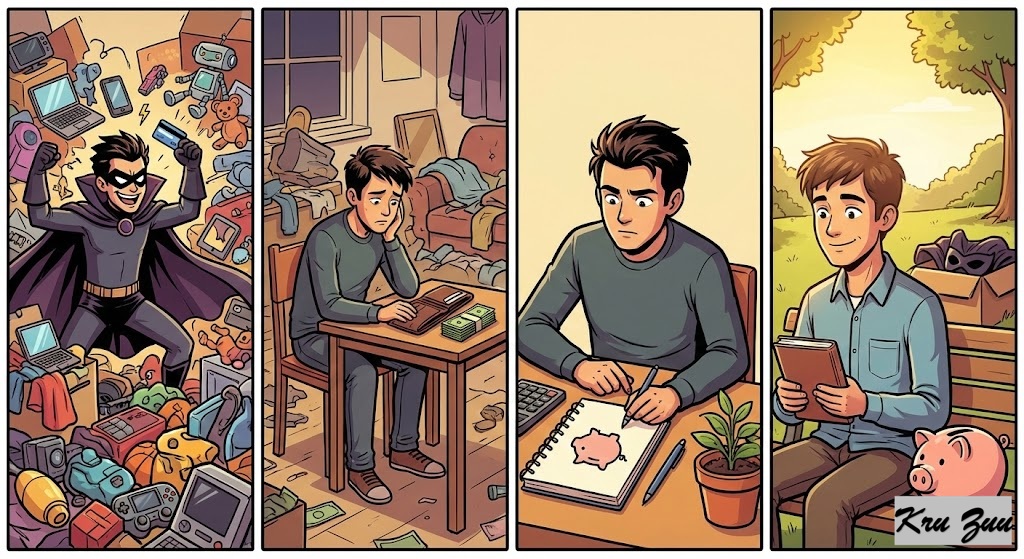

😈 The Villain (The Impulse Spender)

You see it. You want it. You buy it. 💸 “I deserve this treat!””I’ll just put it on the credit card.””The company has plenty of budget, why do they care?” You act as if resources are infinite magic dust. You disconnect the price of an item from the effort it took to earn it.

The Result? You are always broke. You stress about bills at the end of the month. You feel entitled to things you haven’t earned. You are trapped in the “Consumer Trap.” 🛍️

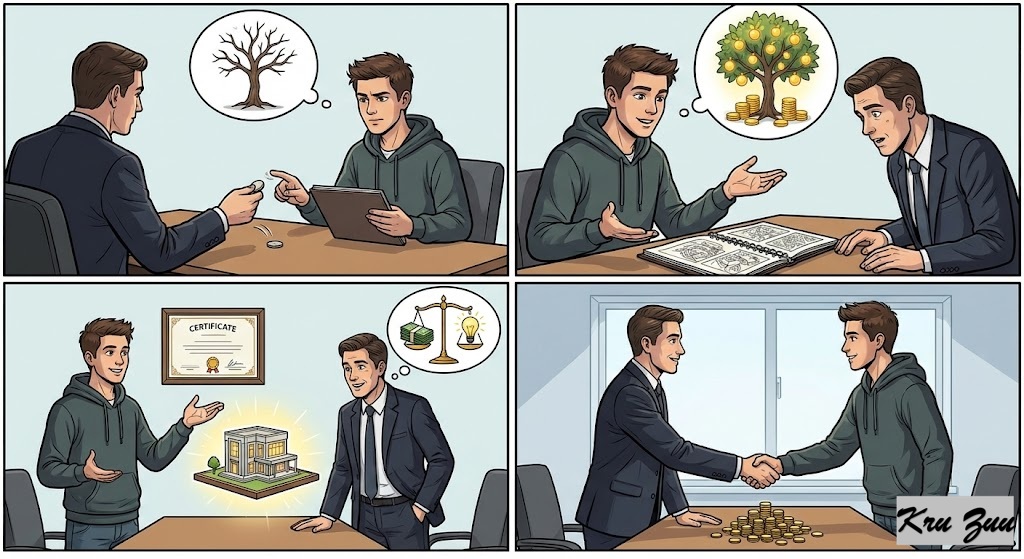

😇 The Hero (The Value Builder)

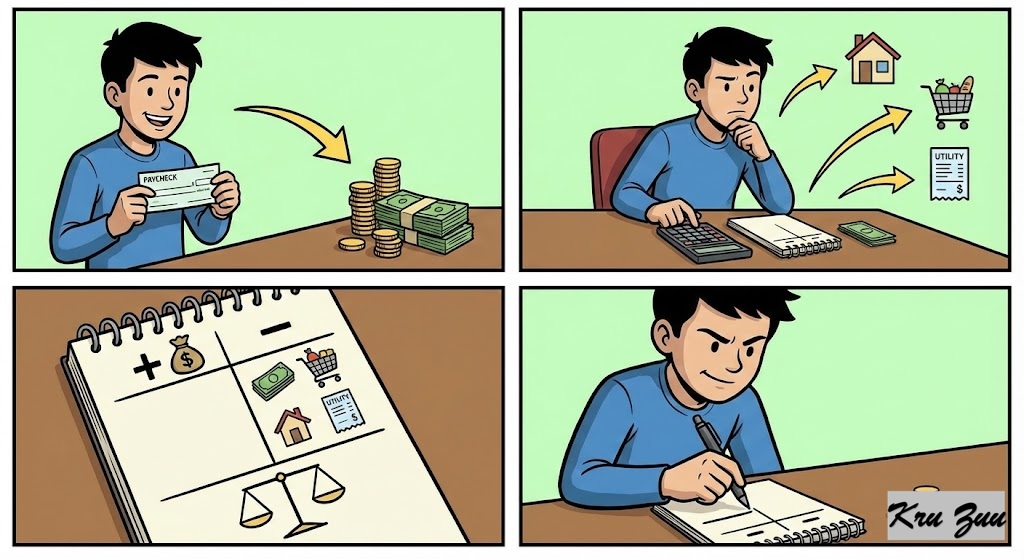

You see something you want. You pause. 🛑 Instead of swiping your card blindly, you calculate the “Life Cost.”

You think: “This fancy coffee costs $5. That is 20 minutes of my hard work.” You respect the energy behind the money.

You say: “I value my effort too much to waste it.”

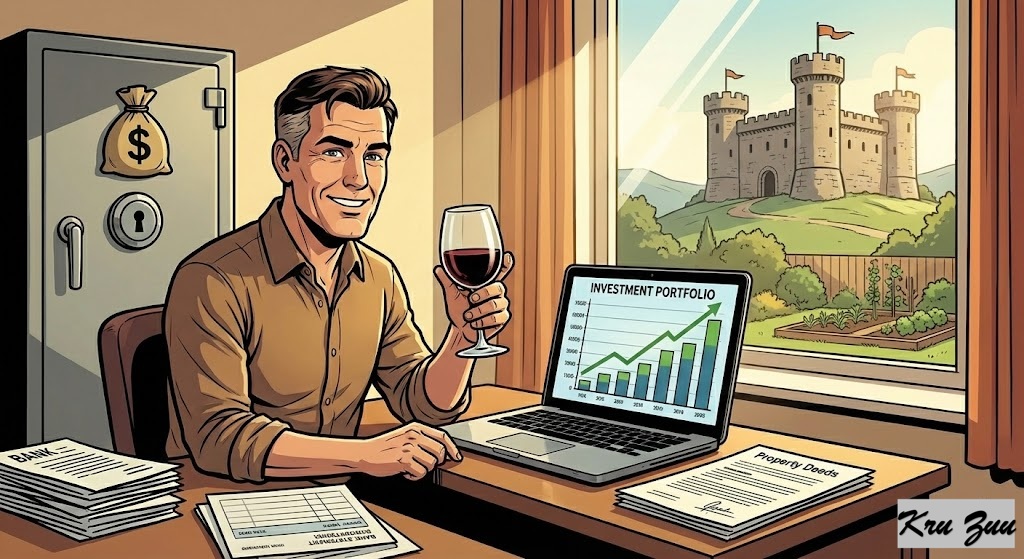

The Result? You build wealth. You have savings for emergencies. You appreciate what you have, and when you do spend, you enjoy it strictly without guilt. You build freedom, not debt. 🏰

⚖️ The Reality

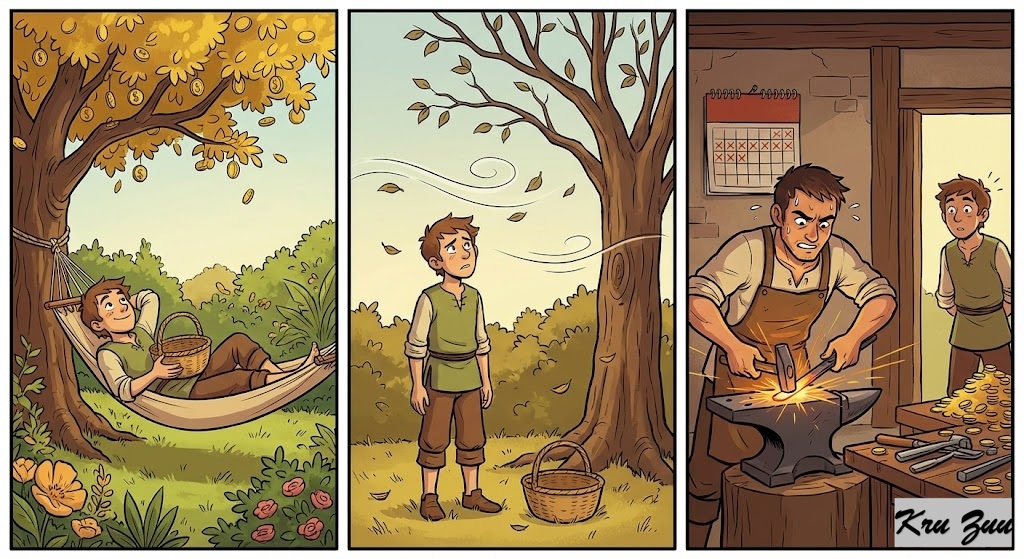

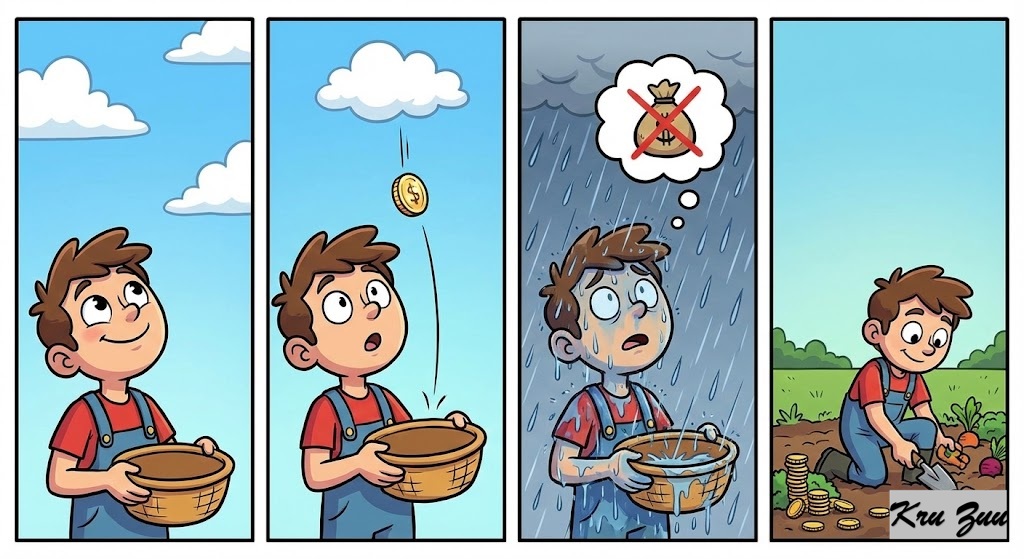

Finite resources vs. Infinite desires. We live in a world where marketing tells us we can have everything now. But the laws of physics and economics are stubborn. Wealth is stored energy. It represents hours of work, stress, and problem-solving. If you treat money like leaves on a tree (infinite and free), you will soon find yourself standing in a barren winter forest with nothing to keep you warm.

💎 The Secret

You don’t just spend money; you spend the time it took you to earn that money. Spend your life wisely.

🧐 The Anatomy of the Proverb

This is your reality check that resources are limited and require labor to obtain.

Money (Noun): Currency, wealth, resources.

Doesn’t Grow (Negative Verb Phrase): Is not naturally produced without effort.

On Trees (Prepositional Phrase): Freely available; easy to pick like an apple.

Simpler Version: Money is hard to earn. / Don’t be wasteful.

📚 Vocabulary Vault

Frugal (Adjective): Sparing or economical with regard to money or food. (Smart with money).

Entitlement (Noun): The belief that one is inherently deserving of privileges or special treatment. 👑

Budget (Noun/Verb): An estimate of income and expenditure for a set period of time.

Expenditure (Noun): The action of spending funds.

Finite (Adjective): Having limits or bounds. (Opposite of infinite).

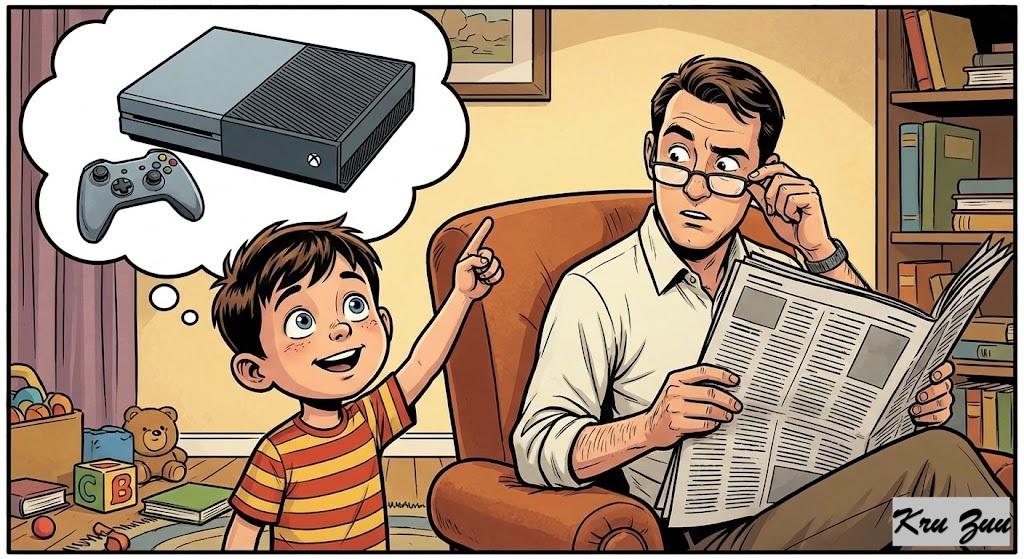

🧠 Grammar Focus: Idioms as Parenting/Bossing Tools

We often use this idiom when someone asks for something expensive or unnecessary.

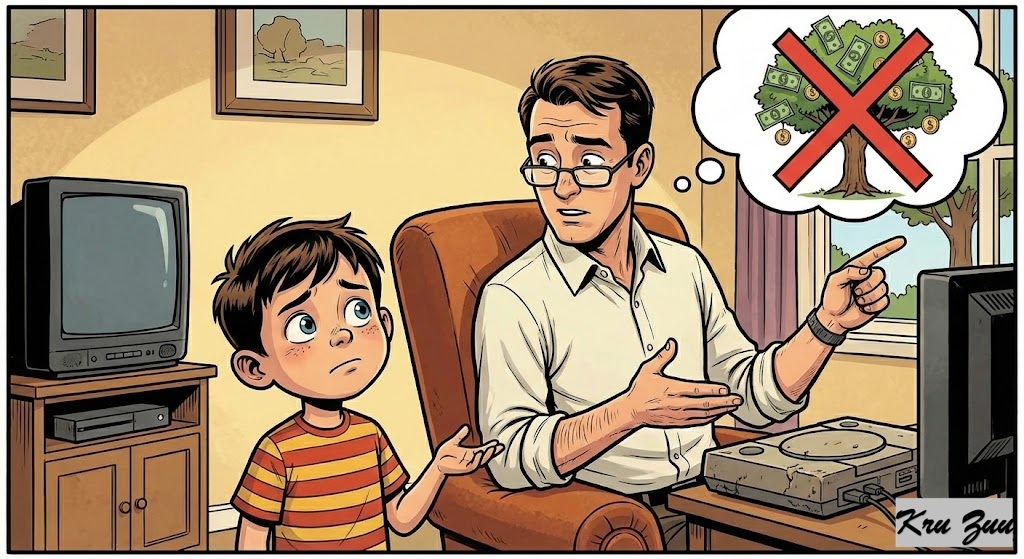

Child: “Dad, can I have the new PlayStation?”

Dad: “Son, look at our old one. It works fine. I can’t just buy everything you see. Money doesn’t grow on trees.”

📜 History: Origin and Spread

Where did this botanical financial advice come from?

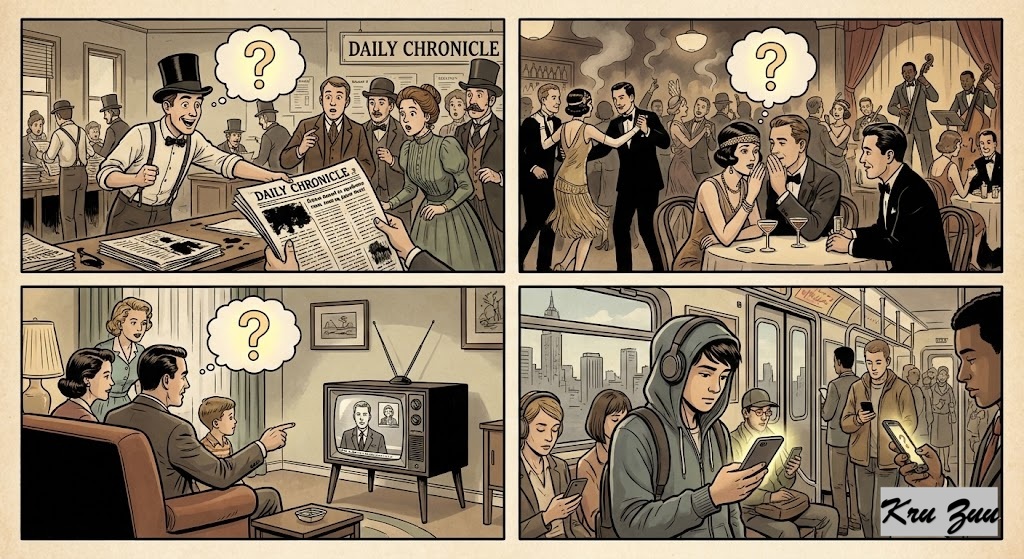

The Origin: While the exact first usage is debated, it appeared in newspapers as early as the 1890s in the USA.

The Logic: Before modern jobs, people worked the land. Picking fruit from a tree was “easy” food. Digging for gold or working in a factory was “hard” money. The idiom contrasts the ease of nature with the difficulty of economics.

The Pinocchio Connection: In the story of Pinocchio, the Fox and the Cat trick him into burying his gold coins to grow a “Money Tree.” The lesson? Only fools believe you can get rich without work.

Global Cousins

🇩🇪 German: “Ich bin doch kein Goldesel.” (I am not a gold-donkey — referring to a fairy tale donkey that spits gold coins).

🇪🇸 Spanish: “El dinero no cae del cielo.” (Money doesn’t fall from the sky).

🇹🇷 Turkish: “Ekmek aslanın ağzında.” (Bread is in the lion’s mouth — meaning earning a living is dangerous and hard).

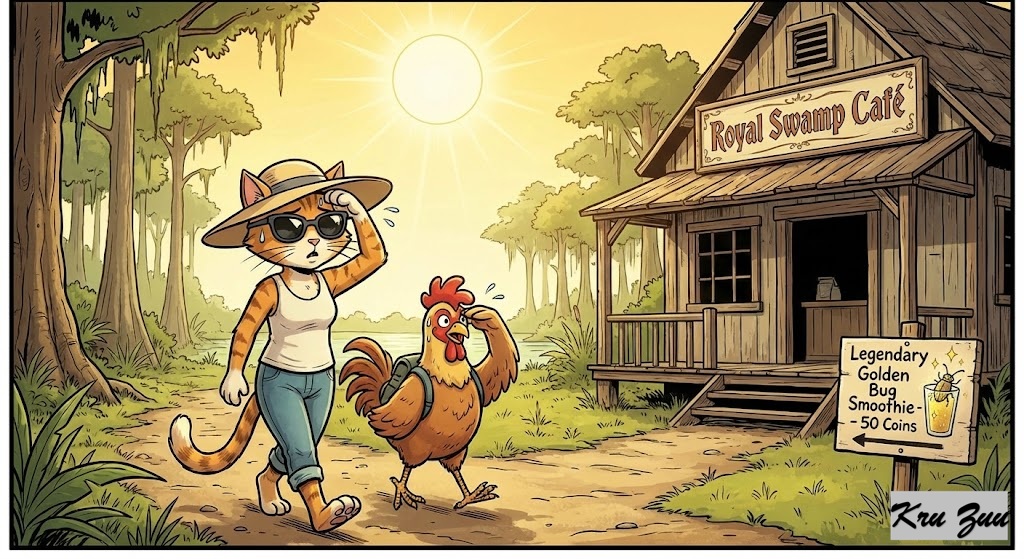

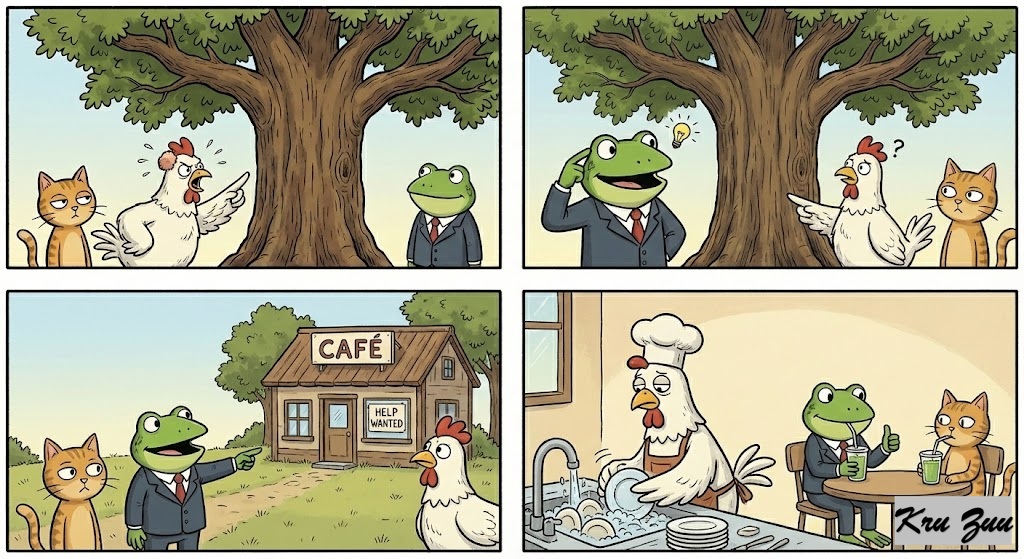

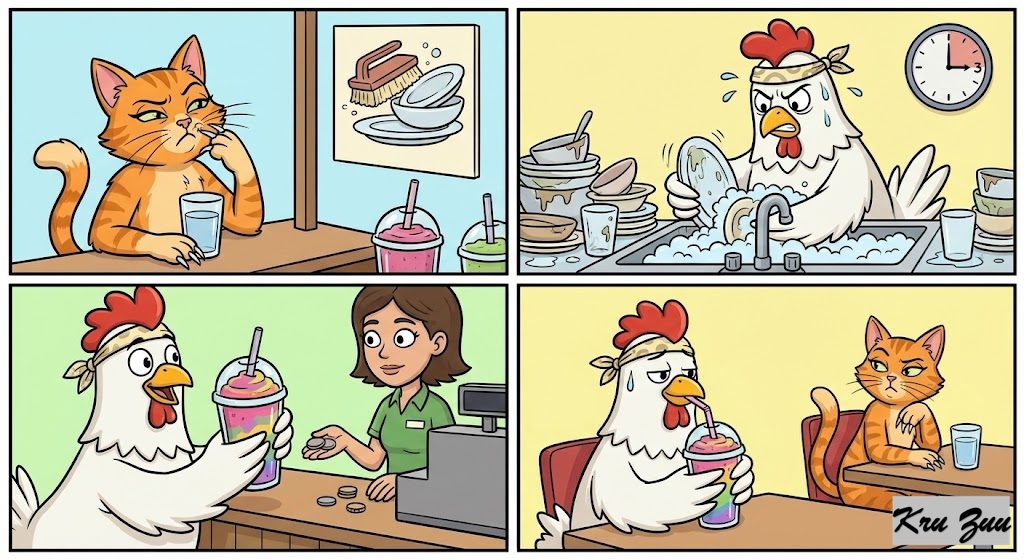

🎭 Short Story: The Golden Smoothie 🥤🐱🐔🐸

Let’s visit the magical forest to see who understands the value of a dollar.

🌟 The Cast

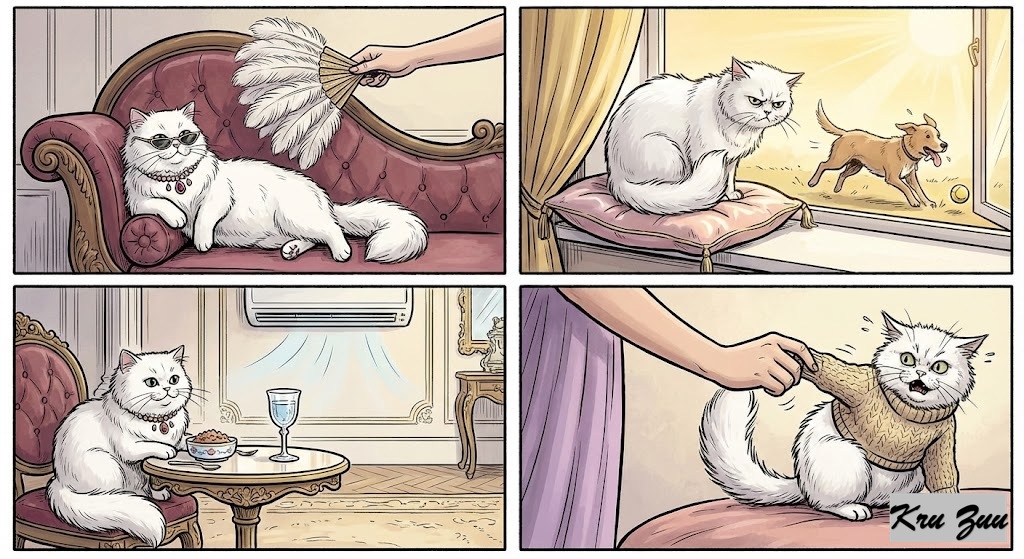

Cleo the Cat: Elegant, loves luxury, hates sweating. 😼

Cluck the Chicken: Impulsive, gets excited easily, easily tricked. 🐔

Fred the Frog: The wise, green accountant. 🐸

The Situation: It is a hot summer day. Cleo and Cluck walk past the “Royal Swamp Café.” They see a sign: “Legendary Golden Bug Smoothie – 50 Coins.”

The Conflict: “I need that smoothie!” Cleo purrs. “It will make my fur shine!” “I want two!” Cluck squawks, hopping up and down. “Let’s buy them now!”

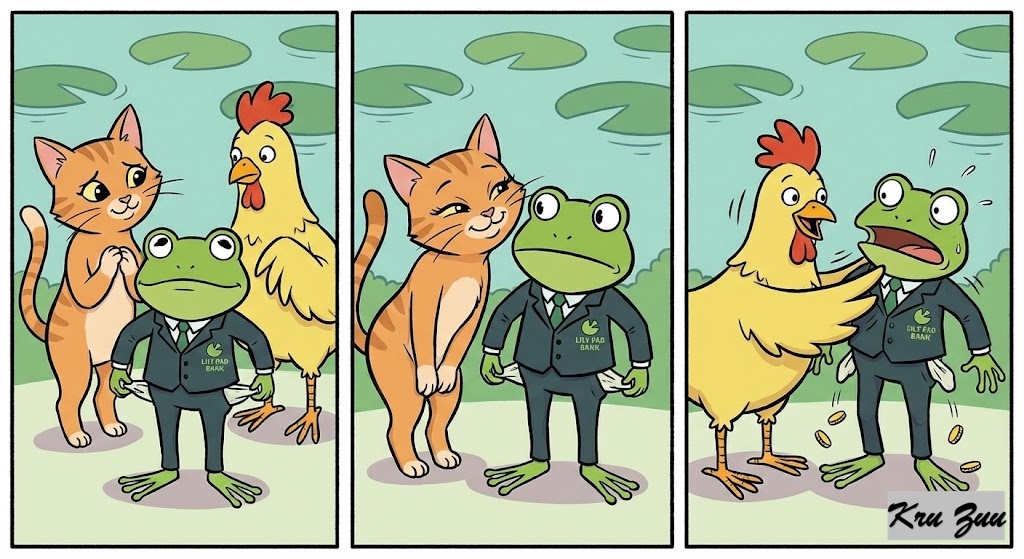

They check their pockets. Empty. Cleo turns to Fred. “Fred, darling. Be a dear and buy us the smoothies. You have a job at the Lily Pad Bank. You have plenty of coins.” Cluck nods. “Yes! Just shake your pockets! Give us the coins!”

The Reaction: Fred adjusts his glasses. He looks at the expensive smoothie, then at his friends. “Ribbit,” says Fred. “Do you know how many flies I have to catch to earn 50 coins? I have to work for three days.”

Cleo rolls her eyes. “Oh, don’t be boring, Fred. Just get it.” Cluck tries to peck Fred’s pocket. “Come on! Don’t be stingy!”

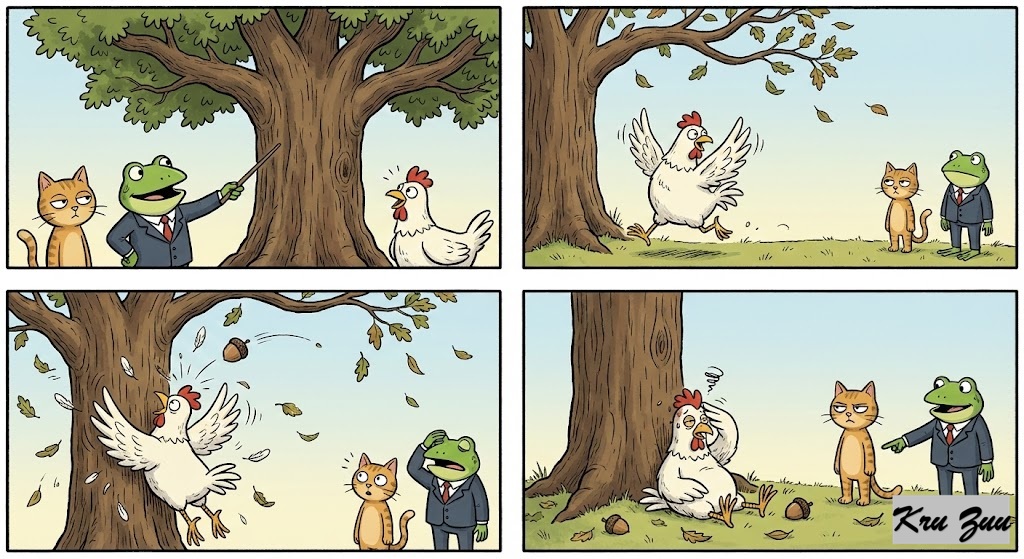

The Lesson: Fred points to a giant Oak tree nearby. “Do you see that tree?” “Yes,” says Cleo. “Go shake it,” Fred commands. Cluck runs over and hits the tree with his wings. Bam! Bam! Leaves fall down. An acorn hits Cluck on the head. But no gold coins fall.

“It’s broken!” Cluck yells. Fred smiles slowly. “The tree isn’t broken, Cluck. But your logic is. Money doesn’t grow on trees. If you want the smoothie, the café is hiring a dishwasher.”

The Resolution: Cleo looked at her manicured claws. “Dishwashing? Ew.” She decided water was fine. Cluck, however, really wanted the smoothie. He washed dishes for 3 hours. When he finally bought the smoothie, he drank it slowly. He didn’t spill a drop. Why? Because he paid for it with his own sweat.

The Moral: When you don’t earn it, you waste it. When you work for it, you taste it. 😋

🎓 Lesson for English Learners

Don’t accept the first price.

Situation: You are negotiating a salary or a freelance rate. The client offers you very little money.

The Shift: You need to politely remind them of your value.

You Say: “I understand you have a budget, but this project requires high-level skills and time. I cannot lower my rate further; money doesn’t grow on trees, and neither does quality work.”

💬 Your Turn: The “Hourly” Challenge 🚀

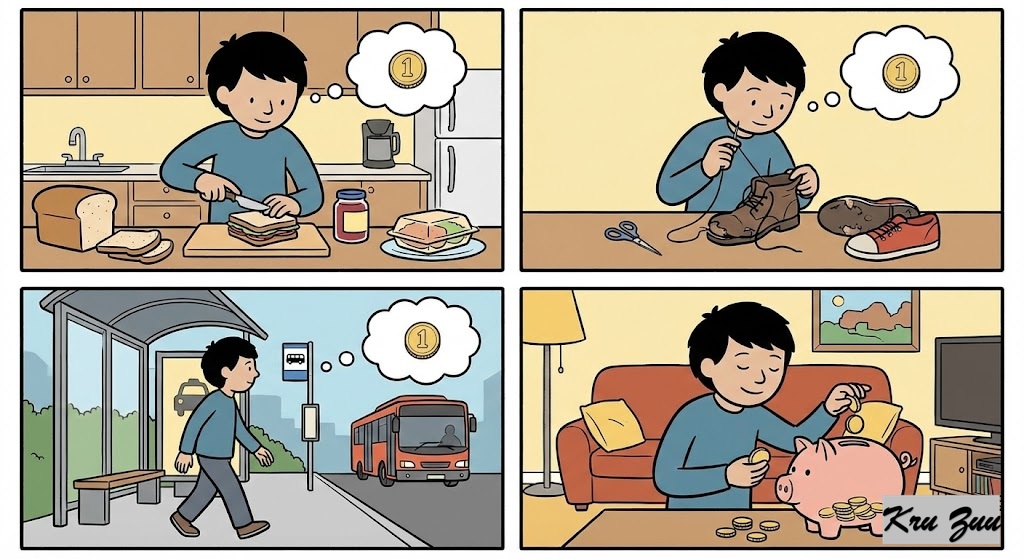

Do you want to cure your “Villain” spending habits?

The Challenge: Calculate your “Hourly Rate” (How much you earn in one hour of work). The Action: Next time you want to buy something unnecessary (a new shirt, a gadget, a fancy meal), divide the price by your hourly rate.

Example: The shoes cost $100. You earn $20/hour. These shoes cost 5 hours of your life.

Ask yourself: “Is this item worth sitting in the office for 5 more hours?”

👇 Question for the comments: What is one thing you used to waste money on, but stopped? How did you learn the value of that money? Tell us below!

https://www.facebook.com/BrainBattleground/

https://www.facebook.com/zubeyr.yurtkuran/

https://www.instagram.com/zubeyryurtkuran/